Land Investment

Top States for Land Investment in 2026: A Comprehensive Guide

As we approach 2026, the landscape for purchasing land is evolving due to economic shifts, climate considerations, and changing buyer preferences. This guide explores the best states to buy land in 2026, examining factors like affordability, investment potential, and local conditions that influence land value.

The land market for 2025-2026 is anticipated to be stable, offering opportunities for strategic investors. Unlike the more volatile residential real estate market, land is expected to reward long-term strategies and informed decision-making. States identified as prime for land purchases in 2026 due to affordability and growth potential include Texas, Florida, and Idaho. These states are recognized for strong investment opportunities, high-growth areas, and favorable land laws and tax incentives. Other states to watch include Arkansas, New Mexico, Mississippi, West Virginia, and Kentucky, which are expected to offer some of the most affordable land options with potential for appreciation.

The demand for recreational land is expected to remain competitive, driven by lifestyle, privacy, and long-term enjoyment rather than speculation. Properties with water features, year-round access, and existing trails are highly desirable. States like Colorado, Montana, and Tennessee are top choices for recreational land. Agricultural land is projected to be one of the most stable land investments, with factors including long-term food demand, limited supply, and institutional investment. Iowa, Nebraska, and Kansas are top choices for agricultural land due to fertile soil and favorable climates.

Urbanization trends and the continued demand for both residential and commercial development outside major cities are also shaping the market. The rise of remote work has increased demand for rural land and properties in less populated areas, as individuals seek affordability and recreational opportunities. Proximity to employment centers, schools, amenities, major highways, and public transportation is crucial for value appreciation. Access to essential utilities (water, electricity, sewage) is critical for land value and development potential.

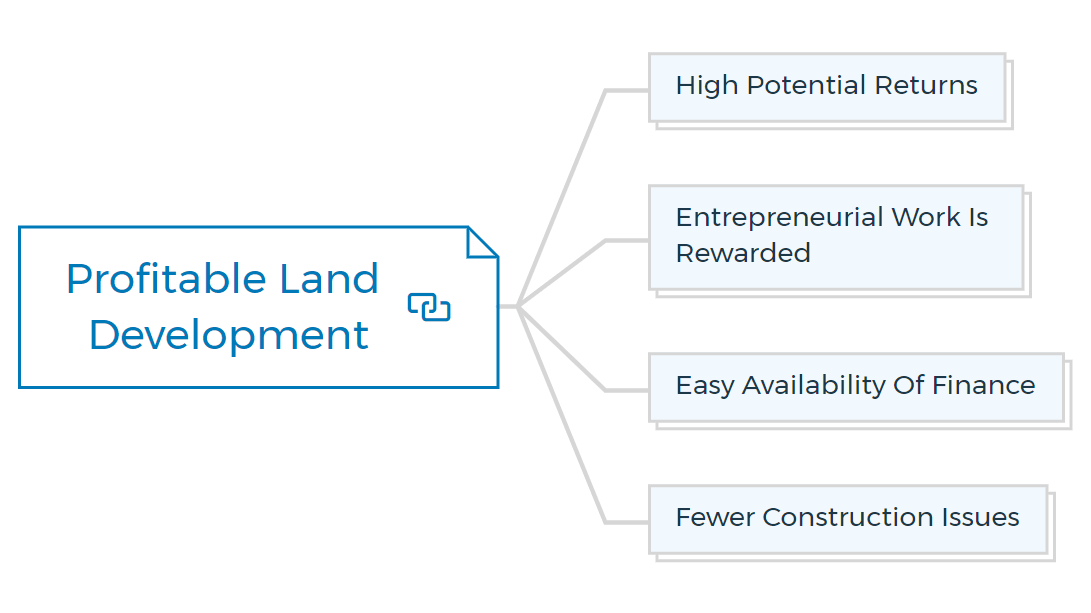

Investment strategies for land include buy-and-hold, flipping, and leasing. The buy-and-hold strategy involves purchasing land for long-term appreciation, capitalizing on market trends and demographic shifts. Land flipping involves buying undervalued properties, making improvements, and reselling for profit. Leasing land can generate passive income through leasing for agricultural purposes, solar panel installations, or recreational use. Reinvesting profits from properties back into existing mortgages or new acquisitions is another effective strategy.