Market Trends

2026 Real Estate Outlook: A Market in Transition

The real estate market in 2026 is expected to be a period of recalibration and rebound, characterized by stabilizing interest rates and a re-alignment of fundamentals. This article provides an analysis of the market, including predictions for mortgage rates, home sales, and home prices.

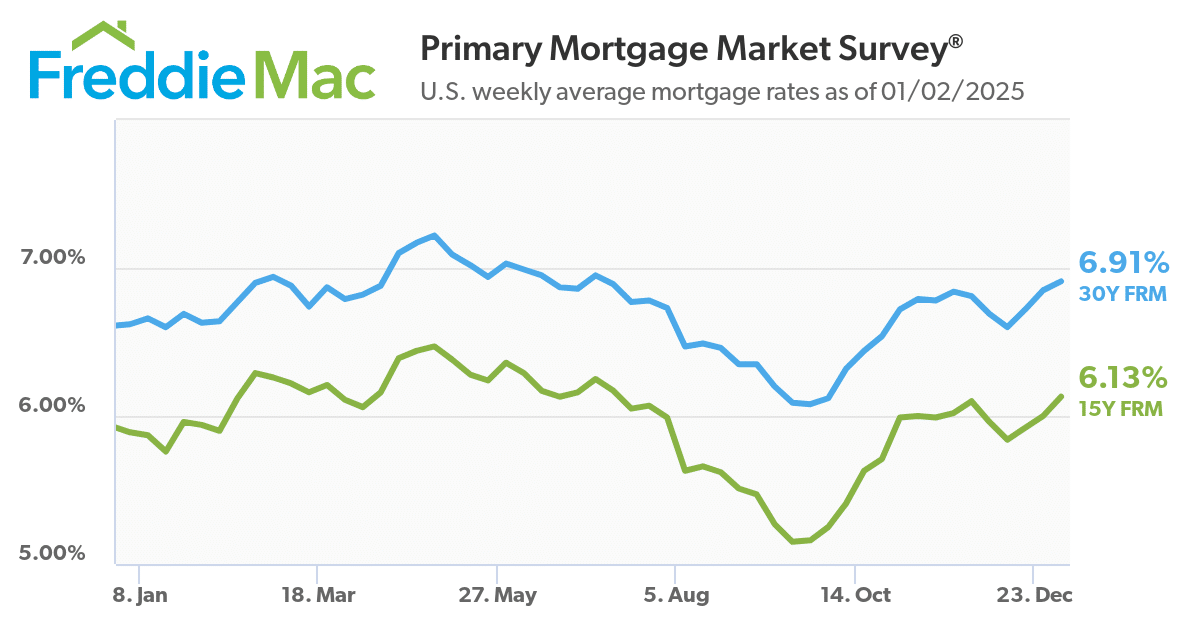

The real estate market in January 2026 is anticipated to be a period of recalibration and rebound, characterized by stabilizing interest rates and a re-alignment of fundamentals. While not a return to speculative highs, it is expected to be a more balanced market with opportunities for prepared buyers and sellers. Mortgage rates are predicted to stabilize between 6.0% and 6.4%, with some experts forecasting an average of 6.15%. Home sales are projected to increase, and home price growth is expected to be moderate, around 2% to 3% nationally.

Regional variations will be significant, with the Midwest and Northeast potentially seeing higher price growth due to persistent inventory scarcity. Affordability challenges remain, but a slight easing is expected as incomes rise faster than home prices. The market is shifting from a seller's market towards a more balanced one. Sellers may need to adjust expectations and be prepared for price cuts, especially for lower-cost homes.

There is some improvement in new-home construction, with a projected 1% gain in single-family home building and new-home sales for 2026. However, a structural housing deficit persists, meaning the housing stock is not large enough for the population. This remains a major constraint on affordability, and building more homes is seen as the solution. Zoning and land-use policies are a significant limitation on the supply side, often restricting the density needed for affordable housing options.

Overall, the real estate market in 2026 is expected to be a 'comeback cycle' and a turning point, moving towards a more balanced state after a period of adjustment. This comeback is not driven by speculation or hype, but by a recalibration of market fundamentals, including stabilizing interest rates and returning certainty.