Market Trends

Real Estate Market Analysis: Is a Crash Coming in 2026?

With rising interest rates and a cooling housing market, many people are wondering if a crash is on the horizon. This article provides an in-depth analysis of the real estate market and what to expect in 2026.

The real estate market has been on a wild ride in recent years, with home prices soaring to record highs. But with interest rates on the rise and the market starting to cool, many people are wondering if a crash is coming. While it's impossible to predict the future with certainty, there are a number of factors that suggest a crash is unlikely. For one, the housing shortage is still a major issue in many parts of the country. This means that even if demand cools, there will still be a limited supply of homes available, which should help to keep prices from falling too far.

Another factor that is supporting the housing market is the fact that many homeowners have a lot of equity in their homes. This means that even if prices do fall, most homeowners will not be underwater on their mortgages. This is in stark contrast to the 2008 housing crisis, when many homeowners had little to no equity in their homes.

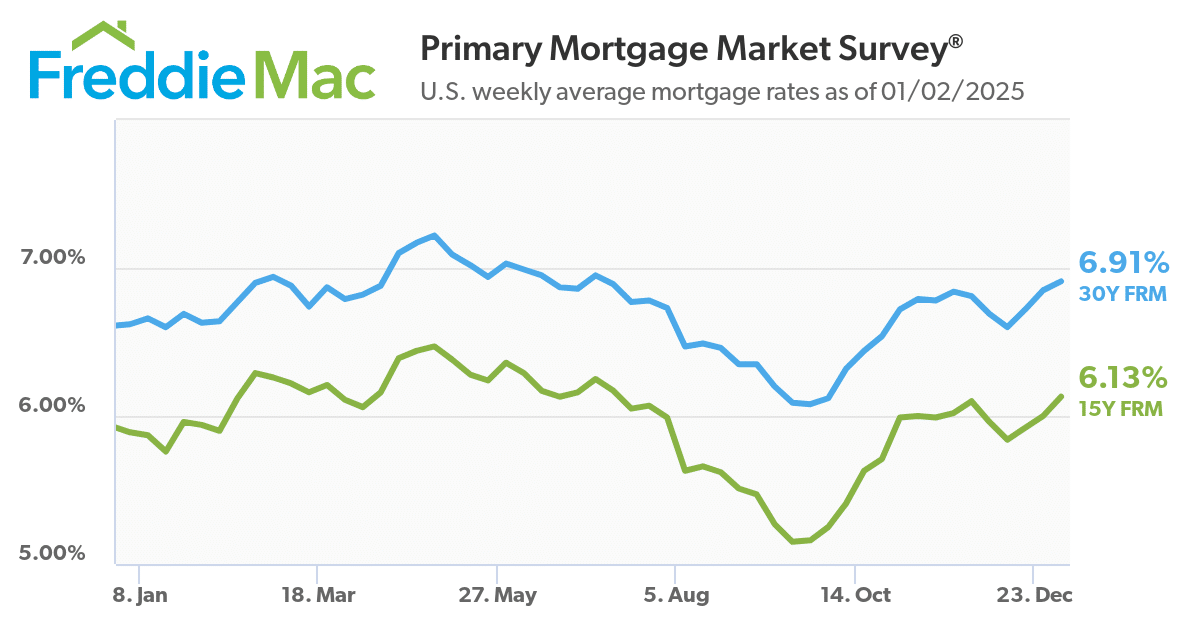

Of course, there are also a number of risks to the housing market. The biggest risk is that the Federal Reserve will raise interest rates too high, which could push the economy into a recession. A recession would likely lead to job losses and a further cooling of the housing market. Another risk is that the housing shortage will be resolved more quickly than expected. This could happen if there is a surge in new construction or if more homeowners decide to sell their homes.

Overall, the real estate market is in a much healthier position than it was in 2008. While there are certainly risks to the market, a full-blown crash is unlikely. Instead, we are more likely to see a gradual cooling of the market, with prices stabilizing or even falling slightly in some areas.